Offshore Company Formation: Structure Your Service Past Borders

Important Do's and Do n'ts of Offshore Company Development

Developing an overseas firm can be a calculated step for many services seeking to broaden their operations internationally or enhance their tax obligation responsibilities. The process of offshore company formation calls for careful factor to consider and adherence to essential standards to guarantee success and conformity with the regulation. From picking the appropriate jurisdiction to navigating complex tax ramifications, there are important do's and do n'ts that can make or break the result of this venture. Comprehending these key variables is critical in protecting the passions and reputation of any type of business venturing right into the offshore realm.

Selecting the Right Territory

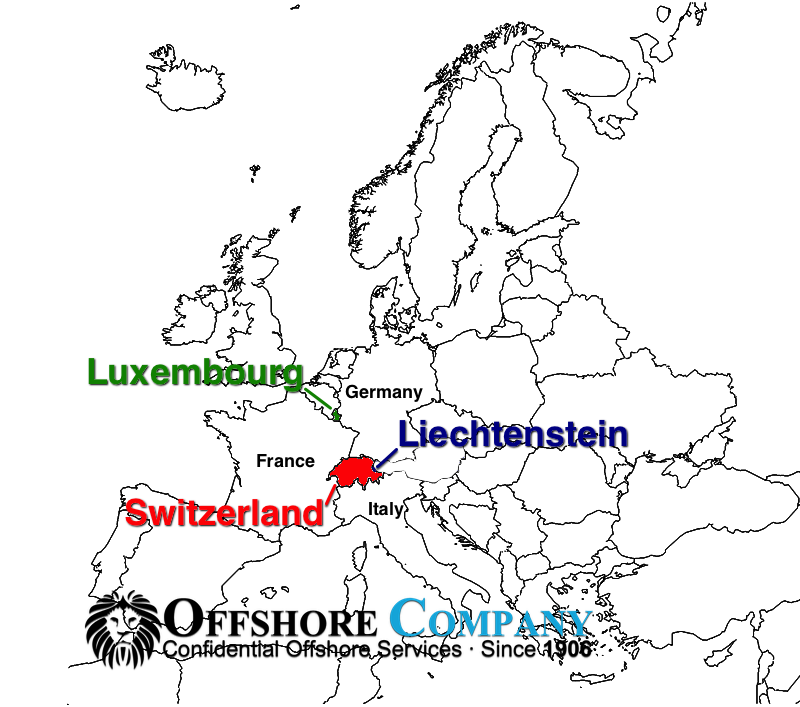

Choosing the proper territory is a critical choice when developing an overseas firm, as it directly impacts the legal, economic, and functional aspects of business. The selected territory will certainly dictate the governing framework within which the business runs, influencing taxation, reporting requirements, personal privacy regulations, and property security. Some territories use much more beneficial tax regimes, while others give better privacy and possession defense actions. It is important to think about elements such as political security, online reputation, ease of operating, and legal system efficiency when picking a jurisdiction for an offshore firm.

Moreover, the chosen jurisdiction ought to straighten with the company's details goals and operational needs. A company focused on international trade might profit from a territory with solid trade agreements and logistical benefits. On the various other hand, a company largely worried with property security may prioritize jurisdictions with durable possession protection regulations. Carrying out thorough study and looking for expert recommendations can help browse the complexities of choosing the ideal jurisdiction for an overseas company.

Understanding Tax Obligation Implications

A crucial facet to think about when developing an offshore business is understanding the tax implications associated with the picked jurisdiction. Different offshore jurisdictions offer varying tax obligation structures, consisting of corporate tax obligation prices, VAT, and other levies that can considerably affect the overall profitability of your overseas venture. It is necessary to conduct comprehensive research study or seek expert recommendations to recognize how these tax obligation laws will impact your business procedures.

One vital aspect to think about is the tax obligation residency regulations in the chosen jurisdiction. Comprehending whether your offshore company will certainly be considered tax obligation citizen in that nation can identify the extent of tax obligation responsibilities you will need to satisfy. Furthermore, acquaint yourself with any tax obligation rewards or exemptions that might be offered for overseas business in the chosen jurisdiction.

Conformity With Regulations

Making certain adherence to regulative requirements is paramount when developing an overseas business to keep legal conformity and alleviate potential dangers. offshore company formation. Offshore jurisdictions have varying laws concerning company formation, procedure, reporting, and click here for more taxation. It is vital to thoroughly research study and understand the details regulatory landscape of the selected territory prior to waging the development procedure

One key element of conformity is the due diligence needs enforced by governing authorities. These demands usually mandate the collection and confirmation of substantial documents to validate the authenticity of the company and its stakeholders. Failing to fulfill these due diligence standards can result in serious penalties, including fines, permit retraction, and even criminal costs.

Looking for specialist support from monetary and lawful experts with proficiency in offshore regulations can also assist in browsing the complicated compliance landscape. By focusing on governing conformity, overseas firms can operate with self-confidence and integrity.

Employing Neighborhood Professionals

When establishing an offshore company, engaging regional specialists can considerably improve the effectiveness and efficiency of the formation procedure. Regional specialists have invaluable knowledge of weblink the regulative structure, social nuances, and company methods in the jurisdiction where the overseas firm is being established. This expertise can streamline the incorporation process, guaranteeing that all legal requirements are met properly and expediently.

Working with neighborhood specialists such as lawyers, accounting professionals, or organization experts can also offer access to a network of calls within the neighborhood organization neighborhood. These connections can facilitate smoother communications with regulative authorities, banks, and other vital company. Furthermore, local specialists can use insights right into market trends, potential opportunities, and challenges details to the offshore territory, helping the firm make notified calculated choices from the start.

Preventing Illegal Tasks

To maintain conformity with legal laws and maintain ethical standards, watchfulness versus participating in immoral practices is extremely important when establishing an overseas business - offshore company formation. Involving in illegal tasks can have severe repercussions, including significant penalties, legal effects, damage to online reputation, and possible closure of the offshore business. It is essential to carry out thorough due diligence on the legislations and laws of the jurisdiction where the find this offshore firm is being developed to guarantee complete conformity

Some typical illegal tasks to prevent consist of money laundering, tax obligation evasion, bribery, corruption, scams, and participation in tasks that sustain terrorism or organized criminal offense. Applying robust anti-money laundering (AML) and know your client (KYC) treatments can aid prevent the company from being utilized as an automobile for prohibited economic tasks. Additionally, staying informed regarding regulative modifications and looking for lawful suggestions when required can further safeguard the offshore company from accidentally obtaining involved in illegal practices. By prioritizing legal compliance and moral actions, overseas firms can run efficiently within the boundaries of the regulation.

Verdict

It is important to think about elements such as political stability, reputation, convenience of doing organization, and lawful system effectiveness when choosing a jurisdiction for an overseas business.

An important aspect to take into consideration when developing an offshore company is understanding the tax implications entailed in the selected jurisdiction. In addition, familiarize yourself with any type of tax motivations or exemptions that may be readily available for offshore firms in the chosen jurisdiction.

It is crucial to carry out extensive due persistance on the laws and laws of the jurisdiction where the overseas business is being developed to make sure full conformity.

In conclusion, adherence to lawful regulations, recognizing tax effects, and selecting the ideal jurisdiction are necessary elements in overseas company formation. - offshore company formation